Loan Service Providers: Helping You Realize Your Monetary Aspirations

Loan Service Providers: Helping You Realize Your Monetary Aspirations

Blog Article

Discover Reliable Car Loan Providers for All Your Financial Demands

In navigating the huge landscape of monetary solutions, locating trustworthy lending providers that accommodate your certain demands can be a challenging job. Whether you are considering personal fundings, on the internet lending institutions, credit score unions, peer-to-peer loaning systems, or government help programs, the options seem countless. Amidst this sea of choices, the important question stays - just how do you recognize the trustworthy and dependable avenues from the remainder? Allow's explore some essential elements to think about when seeking lending services that are not just trusted but additionally tailored to satisfy your one-of-a-kind economic requirements - Financial Assistant.

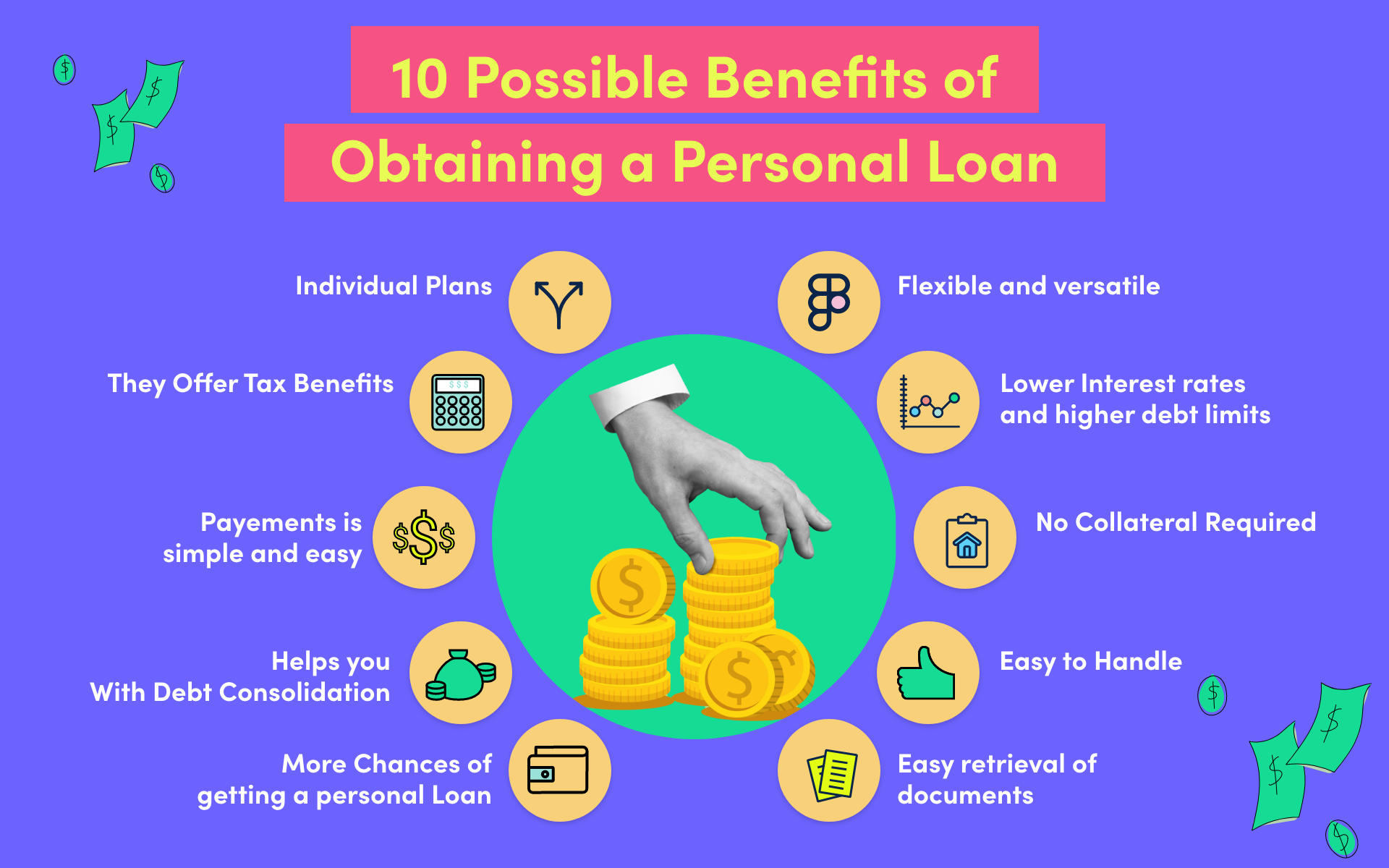

Sorts Of Individual Financings

When taking into consideration personal lendings, people can select from various types tailored to meet their specific monetary requirements. One typical kind is the unprotected individual lending, which does not require collateral and is based upon the debtor's creditworthiness. These car loans normally have higher rates of interest due to the boosted danger for the lending institution. On the various other hand, safeguarded personal financings are backed by collateral, such as a vehicle or savings account, leading to lower rate of interest as the lending institution has a type of protection. For individuals wanting to consolidate high-interest debts, a financial obligation loan consolidation lending is a sensible alternative. This type of lending integrates multiple financial obligations right into a single month-to-month settlement, often with a lower rates of interest. Furthermore, individuals in need of funds for home renovations or major acquisitions might select a home renovation financing. These fundings are specifically designed to cover expenses related to boosting one's home and can be protected or unsecured relying on the lender's terms.

Advantages of Online Lenders

Recognizing Lending Institution Options

Credit report unions are not-for-profit monetary cooperatives that offer an array of items and solutions similar to those of banks, including cost savings and examining accounts, financings, credit report cards, and more. This possession structure usually translates into lower fees, affordable interest prices on car loans and financial savings accounts, and a strong focus on consumer service.

Credit unions can be appealing to people seeking a much more tailored method to banking, as they generally prioritize participant contentment over profits. Additionally, debt unions frequently have a strong neighborhood presence and might use financial education resources to help members boost their economic proficiency. By understanding the alternatives available at cooperative credit union, individuals can make enlightened decisions about where to delegate their financial needs.

Exploring Peer-to-Peer Borrowing

One of the essential tourist attractions of peer-to-peer borrowing is the capacity for lower passion rates compared to standard financial establishments, making it an appealing option for customers. Additionally, the application process for getting a peer-to-peer car loan is typically structured and can result in faster accessibility to funds.

Financiers likewise gain from peer-to-peer lending by potentially gaining higher returns compared to traditional investment alternatives. By removing the intermediary, investors can straight fund debtors and get imp source a portion of the rate of interest repayments. It's crucial to keep in mind that like any kind of financial investment, peer-to-peer financing lugs intrinsic risks, such as the possibility of debtors skipping on their car loans.

Federal Government Support Programs

Amidst the progressing landscape of financial services, a crucial aspect to think about is the world of Entitlement program Programs. These programs play a crucial role in providing financial help and assistance to individuals and services throughout times of need. From welfare to small company car loans, federal government support programs aim to reduce financial burdens and advertise economic security.

One popular example of an entitlement program program is the Local business Management (SBA) fundings. These car loans use beneficial terms and low-interest rates to help local business expand and navigate difficulties - top merchant cash advance companies. Additionally, programs like the Supplemental Nutrition Help Program (SNAP) and Temporary Support for Needy Families (TANF) offer vital assistance for individuals and families dealing with economic hardship

Moreover, entitlement program programs extend beyond financial assistance, encompassing real estate aid, health care subsidies, and educational gives. These initiatives aim to resolve systemic inequalities, advertise social welfare, and make sure that all citizens have accessibility to fundamental requirements and opportunities for development. By leveraging federal government assistance programs, people and services can weather financial storms and strive in the direction of a much more safe economic future.

Final Thought

Report this page